Industry

BFSI

BFSI

APAC

Customized Credit Application Scorecard

A premier APAC-based NBFC’s pre-existing incumbent process for credit risk assessment was driven by a rule-based algorithm that was posing problems in maintaining consistency and timeliness. The field verification data used for the process proved inadequate and there was heavy reliance on bureau data to make up for the inconsistencies. The dependency proved problematic as the bureau data did not comprise all the required information about the target population.

To enable operational efficiency, TheMathCompany collaborated with the IT & digital team of the organization and developed a customized credit risk assessment application that gave an all-encompassing view of customer data, generated a score card to gauge suitability of credit applications and offered real-time insights. Critical lines of business were identified for implementation, data quality was improved to enable efficiency, and data sources were strengthened and diversified. The ML-driven solutioning would help improve modelling accuracy and stability, and the time taken from information capture to response.

A customized application was built for the client to enable improved data capture, track pertinent factors that determined credit risk application acceptance/rejection and better train models to improve scorecard accuracy.

To facilitate the same, TheMathCompany re-designed the existing survey questionnaires being used for field verification visits by taking into account quantifiable risk metrics. This way, all the applications and visits would be documented.

The team also worked towards setting up a customized model design that accounted for business requirements and market parameters, and established guidelines to facilitate effective model monitoring, specifically focusing on input data quality controls, business strategy changes and model health KPIs.

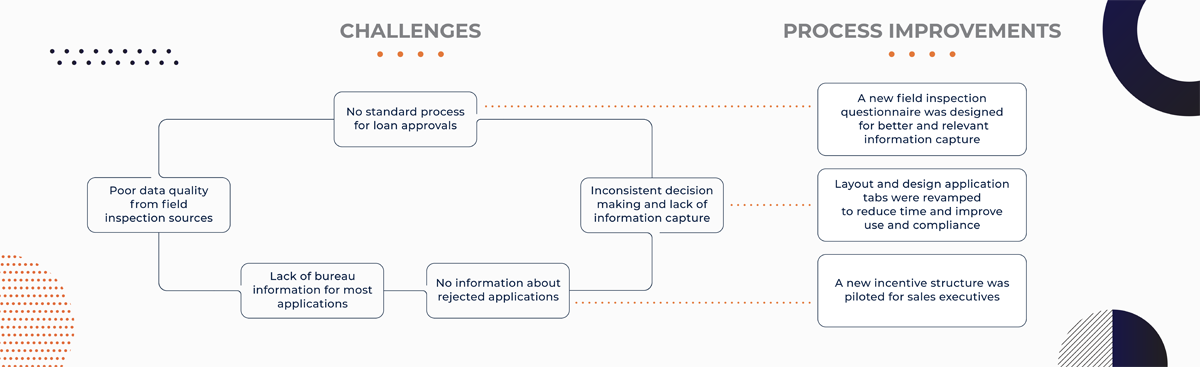

Here's an overview of process improvement measures introduced by our TheMathCompany solutioning team:

(Fig i): Overview of the process improvement

Efficiency Enablement: Out of the 8 business lines, three critical lines of business were identified, and credit application scorecards were developed for the same. The dynamic nature of the business was taken into account, and observation and performance windows were chosen, accordingly. Strong data sources including those relating to application, bureau and field visits were identified to reduce dependency on incomplete data.

Optimum Deployment: A variety of math-based techniques such as binning, group-wise segmentation, and classification models like logistic regression and decision trees were developed in the process of scorecard generation.

ML-driven solutioning: By leveraging ML techniques, TheMathCompany further diversified application in application scorecards, such as boosting accuracy through surrogate models, improving model stability with ML based sampling & k-fold validation techniques.

The resulting application scorecard had a 93% model prediction accuracy, which would only improve with time. The results generated through the scorecard helped decision makers to extensively assess rejection and improve trust in credit quality. Furthermore, the time taken from information capture to response was delivered within 120 seconds. The existing default rate was 15.82% and this was brought down to an estimated 8.8%, i.e., brought down by almost 50%.

Blogs April 8, 2021

Q&A with Nabeel Ahmed: Marketing Analytics in the Automotive Industry

Blogs June 6, 2022

How Hyper-Personalization is Shaping Patient Support Programs

Blogs June 7, 2022

Architecting MLOps Solutions for Healthcare

Blogs July 23, 2022

Unlocking Experiential Automotive Marketing with AI & ML

Blogs Oct. 20, 2022

The AI Bill of Rights: A welcome step toward tech accountability

Blogs July 15, 2022

How CPG Businesses are Utilizing Data to Mitigate Inflationary Risk

Stay up to date with the latest marketing, sales, and service tips and news.

Subscribe to our newsletter to receive latest updates